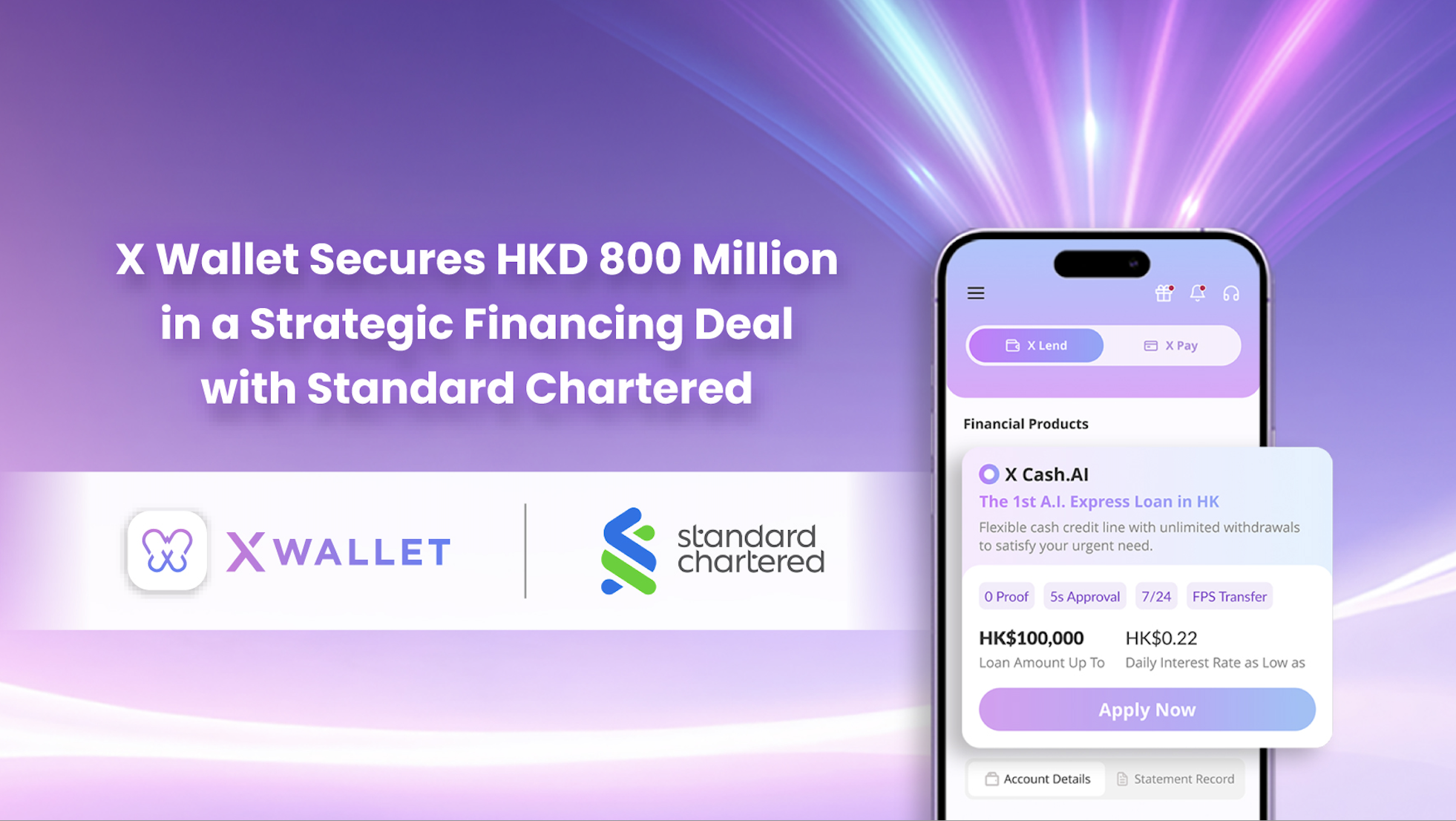

HONG KONG SAR – Media OutReach Newswire – 9 December 2024 – Zero Fintech Group (00093.HK) is thrilled to announce a strategic financing deal with Standard Chartered Bank (Hong Kong) Limited (“Standard Chartered”) (02888.HK) to enhance A.I. financing solutions for X Wallet. In 2024, registered users of the X Wallet App have seen an impressive uplift of 209% year-over-year, with monthly active users growing by 224%. This collaboration includes a funding limit of up to HKD800 Million from Standard Chartered to support the Group’s asset and business growth.

This partnership is a pivotal move for Zero Fintech Group as it seeks to leverage proprietary A.I. technology of X Wallet to drive efficiency and innovation within the financial sector. With Standard Chartered’s funding support, X Wallet will enhance its capabilities to provide users with streamlined, cost-effective financial solutions tailored to their needs.

Carlos Chau, Executive Director at Zero Fintech Group, said, “We are excited to join forces with Standard Chartered to elevate X Wallet’s offerings. This funding support not only fuels our technological advancements but also allows us to focus on building a robust financial ecosystem that prioritizes cost efficiency and user-centric solutions.”

The funding support by Standard Chartered will also facilitate the creation of a comprehensive financial ecosystem in X Wallet, integrating various Fintech services to provide users with seamless access to a wide range of financial products from lending to payment. This holistic approach aims to redefine customer experience and empower users in their financial journeys.

Hashtag: #ZeroFintechGroup

The issuer is solely responsible for the content of this announcement.

About X Wallet

X Wallet is a cutting-edge Fintech mobile app, developed by Zero Fintech Group in 2018. As the first AI-powered digital lending app in Hong Kong, X Wallet combines advanced lending features with a seamless Buy Now, Pay Later payment solution.

Its flagship product, X Cash.AI, delivers a fully automated lending experience, approving loans within 5 seconds without any need for human intervention. This breakthrough innovation redefines traditional lending and payment methods, offering users a faster and more efficient financial experience.