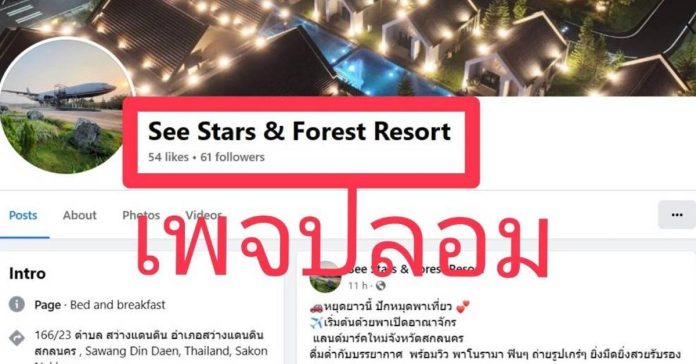

Residents are expressing their frustrations on social media regarding the cumbersome process of obtaining passports, despite recent announcements about the availability of numerous online queues.

VinFast to participate in Indonesia International Motor Show 2024 and officially launch in Indonesia

At IIMS 2024, VinFast will display a range of electric vehicles across various segments. This is also the first time VinFast will introduce right-hand drive electric vehicle models to the international market, affirming its strong dedication to making electric vehicles accessible to everyone.

VinFast is committed to providing customers in the Indonesian market with diverse and exciting green mobility offerings. The company’s wide range of electric vehicles cater to the travel needs and financial capabilities of various consumers. To make these offerings even more accessible, VinFast will offer superior after-sales policies and flexible sales plans, bringing its electric vehicles more accessible to everyone in Indonesia.

Mr. Tran Quoc Huy, VinFast Indonesia CEO, said: “VinFast is delighted to formally launch its brand in the Indonesian market at IIMS 2024. We aim to provide local customers with more eco-friendly transportation offerings, along with a commitment to accompany them throughout the electric vehicle ownership journey. We look forward to inspiring the market to explore the limitless potential of a modern and sustainable mobility future.”

With a population of 250 million people, Indonesia is the largest economy in Southeast Asia and one of the largest automotive markets in the region. With a growing focus on electrifying transportation and a series of government support policies for the electric vehicle industry, Indonesia will be one of the key markets in VinFast’s development strategy.

Indonesia represents the next key market for the company while also being a strategic link in its global electric vehicle supply chain. The company previously announced an investment in the construction of a manufacturing plant with an annual capacity of up to 50,000 electric vehicles. Once operational, the factory in Indonesia will not only produce vehicles for the market but also strengthen VinFast’s supply chain and competitiveness globally.

VinFast’s booth will be open to visitors from 5:00 PM (local time) on February 15, 2024, to February 25, 2024. Also, on February 15, VinFast will host a brand launch press event that will take place at 2:00 PM at Booth A6, Hall A, Jakarta International Expo.

Hashtag: #VinFast

The issuer is solely responsible for the content of this announcement.

Celebrate the New Year with the Guinness World Record-breaking 33-meter-long Flying Balloon Dragon in Hong Kong tmtplaza

From now until February 18, 2024, the majestic flying golden dragon graces the atrium in tmtplaza. Every detail, including the horns, whiskers, and eyeballs, has been meticulously crafted, bringing the dragon to life in a breathtaking manner. This grand display symbolizes the prosperous new year that lies ahead, showcasing the artistry and elegance of the balloon sculpture.

Hashtag: #tmtplaza

The issuer is solely responsible for the content of this announcement.

About tmtplaza

Located at the heart of Tuen Mun downtown, tmtplaza is the largest shopping and lifestyle flagship in Northwest New Territories with connection to major transportation nodes. It brings together more than 300 international brands and niche labels under one roof, among them are over 40 international beauty stores in the dedicated Beauty World, coupled with nearly 100 fashion and accessory brands and some 40 dining options to offer a 360-degree shopping experience.

Thai Prosecutors Say Former Prime Minister Thaksin Is Being Investigated for Royal Defamation

State prosecutors in Thailand said Tuesday they have revived an investigation into whether former Prime Minister Thaksin Shinawatra almost nine years ago violated the law against defaming the monarch, a crime punishable by up to 15 years in prison.

Illegal Transport of Siamese Rosewood Logs Foiled by Savannakhet Authorities

Savannakhet authorities successfully intercepted a red and white bus full of Siamese rosewood logs on 5 February potentially to be smuggled to Vietnam.

President Welcomes Four New Ambassadors to Laos

Lao President Thongloun Sisoulith extended a warm welcome to four newly appointed ambassadors in a diplomatic ceremony on 5 February in Vientiane.

Tensions Run High in New Zealand Ahead of National Day Over Government’s Relationship With Maori

WAITANGI, New Zealand (AP) — In a fiery exchange at the birthplace of modern New Zealand, Indigenous leaders on Monday strongly criticized the government’s approach to Maori, ahead of the country’s national day.