MACAU SAR – EQS Newswire – 23 October 2024 – On October 20, the Annual Conference of Financial Street Forum 2024 was concluded in Beijing. Themed on “Trust and Confidence – Work Together to Promote Financial Openness, Cooperate for Shared Economic Stability and Growth”, this year’s conference attracted over 500 guests from more than 30 countries and regions worldwide. In a parallel session featured “Fintech: Bridging the Digital Divide”, notable speakers such as Yin Yanlin, Deputy Director of the Economic Committee of the 14th CPPCC National Committee, Zeng Zhicheng, Deputy Director-General of the People’s Bank of China Beijing Municipal Branch, Jiang Guangzhi, Director of Beijing Municipal Bureau of Economy and Information Technology, Han Xinyi, President of Ant Group, and Sun Ho, Chairman and CEO of Macau Pass Group Holdings Limited, shared innovative practices and offered suggestions. They emphasized the importance of leveraging fintech to enhance real economy financial services, reaching more people and businesses through advancements in tech finance, green finance, inclusive finance, pension finance, and digital finance.

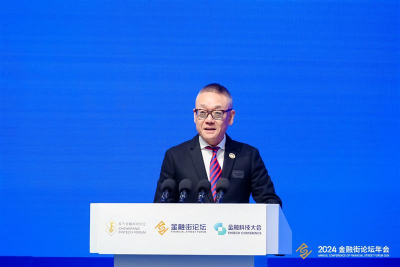

Sun Ho highlighted the potential of fintech in transforming Macau into a smarter city. He mentioned the Macao SAR Government’s ‘1+4’ strategy, which promotes modern finance as a key pillar for economic diversification. Macau Pass is aligning with this initiative by providing convenient life and inclusive financial services to consumers and businesses through digital products, technology, and data capabilities, while contributing to the digital economy and the infrastructure needed for a smart city.

Macau Pass is committed to creating an open, one-stop platform for digital living and financial services, leading Macau’s mobile payment sector through technological innovation and integrating everyday consumption and service scenarios. MPay has become the preferential electronic payment platform for Macau residents and has expanded into a super app covering various scenarios such as retail, dining, culture, leisure, and tourism, offering users convenient local services. Furthermore, Macau Pass is leveraging its substantial user base to assist merchants in their digital transformation and growth. MPay is now accepted by over 98% of Macau’s merchants, playing a significant role in their online operations. In collaboration with Alipay+ cross-border solutions, MPay has extended its payment services to 50 countries and regions, supporting over 10 overseas e-wallets for payments in Macau, enhancing the convenience for both residents and visitors.

Macau Pass has issued over 5 million mCards, continually enhancing users’ smart travel and payment experiences with innovative features. The upcoming launch of the Macau Pass – China T-Union Card aims to simplify public transportation for Macau residents traveling between mainland China and the Macau SAR, making commutes more convenient.

Mr. Sun also shared insights into smart finance innovations. As a licensed bank in Macau, Ant Bank (Macao) leverages advanced technology to offer digital banking, internet securities investment, and insurance services, ensuring safe, inclusive, and convenient financial solutions. By synergizing Macau Pass’s payment services with Ant Bank (Macao)’s digital banking, they plan to integrate “payment plus inclusive finance” services with business scenarios and resources of the ecosystem, thus meeting the diversified financial needs of the market, and driving the smart city’s digital economy forward.

The issuer is solely responsible for the content of this announcement.