KUALA LUMPUR, MALAYSIA – Media OutReach Newswire – 1 August 2024 – To celebrate Octa’s 13th birthday, the broker’s experts share 13 time-tested trading tips, each rooted in extensive research of traders’ real-life experiences. These 13 recommendations are divided into three articles covering five general approaches, five specific skills, and three authentic stories of successful Forex traders. Below is the second article in the series, showcasing five specific skill sets that will positively impact the results and speed up towards consistent gains.

According to the experts at Octa, a broker with globally recognised licences, trading in the financial markets is a skill-based activity that rewards a systematic approach and deliberate acquisition of knowledge. This is especially true for the Forex market with its high liquidity and numerous factors impacting price fluctuations. Below are five specific skill sets that will help trader better understand the mechanics of the trading process and step up the results.

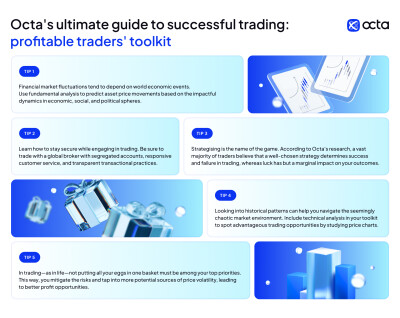

1. Fundamental analysis

There are two generic types of analysis in trading: fundamental and technical. These terms may look daunting to a non-specialist, but the gist of it is simple. Understanding both types of analysis is instrumental in successfully navigating the practical aspects of trading. This knowledge is a launchpad for future gains.

In the case of fundamental analysis, traders evaluate an asset’s value by examining related economic, financial, and regulatory factors such as GDP growth, interest rates, inflation, and unemployment rates. Fundamental analysis aims to understand the underlying forces driving market prices, providing a long-term perspective that helps make informed trading choices.

In Forex, the number of contributing factors for each currency pair is limited. Because of that, any trader can learn and use fundamental analysis to their advantage by learning the ins and outs of fundamental analysis and applying it in their trading sessions.

2. Technical analysis

Technical analysis involves examining historical price movements and trading volumes to forecast future market behaviour. Seasoned traders use charts and statistical indicators to identify patterns and trends and use this information to predict future price movements.

This method assumes that all relevant information is already reflected in the price and that past trading activity can predict future movements. By analysing price action and market psychology, technical analysts aim to make informed decisions on entry and exit points, enhancing their trading strategies with insights derived from market behaviour and historical data.

In Forex trading, the number of potentially applicable indicators and patterns is quite large, and integrating the ones relevant to the traders in their strategy may be challenging for emerging traders. To help them, Octa has recently introduced a dedicated analytical toolkit embedded into its trading platform, OctaTrader. This feed of actionable expert insights can be tailored to the trader’s needs. OctaTrader now has an analytics hub that consistently supports the decision-making process and helps traders save time on research while making data-driven decisions.

3. Portfolio diversification

In trading, traders need to be flexible and adaptable. Fine-tuning strategies as you go, putting the less successful assets on hold, and doubling down on those that brought profit will help stay afloat regardless of market conditions. The first step to achieving this consistent and fluid state is to diversify the asset portfolio.

Portfolio diversification allows traders to mitigate risk and enhance potential returns. By holding a mix of currencies, commodities, or other tradable instruments, traders can reduce the impact of adverse movements in any single asset or economic region, capitalising on market movements and opportunities.

4. Security

With scams and financial fraud rising worldwide, traders should take a proactive stance towards securing their funds. Instead of trusting online gurus and murky promotions advertised through unverified second-party channels, the experts at Octa recommend choosing a financial broker with extensive experience and global presence.

A long and successful track record allows brokers to develop expertise in securing the clients’ funds and personal data. Among other qualities, a trustworthy broker should provide its clients with segregated accounts—in other words, not to use its clients’ capital for operational purposes. Account segregation prevents any financial malpractices on the broker’s side and empowers traders by freeing them from any concerns regarding the safety of their personal information and capital.

Other crucial qualities of a reliable broker include transparent trading conditions and responsive and competent customer service. Both are extremely important in delivering a stress-free trading environment where traders can thrive and make progress towards their financial goals.

5. Strategy

Octa has interviewed some of its clients who started strong in Forex trading and are well on their way to their long-term financial goals. Most of them list a sound strategy as a primary driver of their success. In Forex, strategy—not luck—is the magical ingredient that turns trading into a consistent source of supplementary income that many successful traders use to cover their day-to-day needs. If traders rely on intuition alone, they won’t be able to take stock of your outcomes and devise the measures required for improvement. Strategy makes trading comprehensible and gives control over decisions.

Strategising in trading includes choosing a time frame that suits temperament, picking assets that match the financial goals, and developing a set of criteria traders will use for opening and closing orders. Of course, when it comes to details, things are not quite as easy as that. Still, the generic benefits of strategising are undeniable: it allows traders to turn chaos into order and start paving the way to success.

The next article will conclude the series with three real-life examples of traders successfully putting our 13 tips into practice. Three of Octa’s clients will talk about their trading journeys. Read the third article to peek into three successful traders’ mindsets.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

![]() Octa is an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

Octa is an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In the APAC region, Octa received the ‘Best Trading Platform Malaysia 2024’ and the ‘Most Reliable Broker Asia 2023’ awards from Brands and Business Magazine and International Global Forex Awards, respectively.