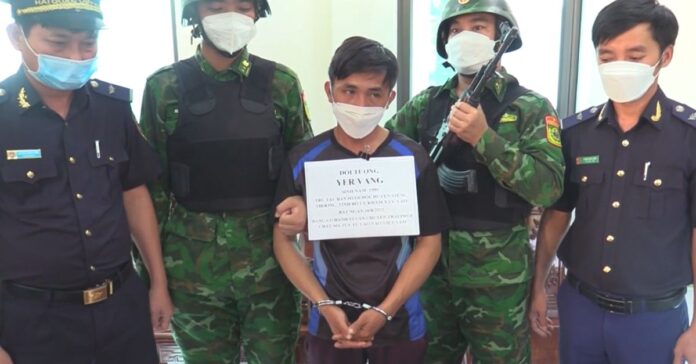

A Lao national was issued the death penalty in Vietnam for trying to transport narcotics across the Ha Thin Border in August 2022, for which he was paid only USD 42.

Thai Flight Attendants Penalized For Neglecting Food Trays Until Landing

Flight attendants from Thai Airways have been issued a one-month suspension and pay cuts for not collecting food trays from customers until landing.

Ministry of Finance Issues New Electronic Road Tax Stickers for 2023

Laos’ Ministry of Finance has introduced new electronic road tax stickers that can be used in place of traditional physical stickers.

Hong Kong Design Centre Welcomes the Additional Resources to Foster the Development of Hong Kong into an East-meets-West Centre for International Cultural Exchange in 2023-24 Budget Address

HKDC Chairman, Prof. Eric Yim, remarked, ‘The unleash of the design power in Hong Kong could help enhance the competitiveness and better fulfil our key roles under the 14th Five-Year Plan. Taking advantage of these immense opportunities, HKDC will strengthen our mission of raising Hong Kong’s position as an international design centre in Asia through signature events like Business of Design Week (BODW) and other programmes. We will continue to work closely with different partners and stakeholders to strengthen the creative industries and foster the continuous growth of the design economy.’

Hong Kong’s positioning as an East‑meets‑West centre for international cultural exchange has been laid out clearly as one of the major directions for Hong Kong and its crucial roles in national development, in accordance with the 14th Five-Year Plan. In fulfilling this role, HKDC believes a comprehensive blueprint for fostering the development of the Design Industry and Economy including nurturing a diverse talent pool, enriching arts, cultural and creative content as well as upgrading cultural infrastructure is crucial not only to bring significant cultural values to Hong Kong but also make the design industry become a main driver of economic and environmental values to the wider economy and community.

HKDC welcomes the additional resources for the CreateSmart Initiative and funding support to be provided to implement the flagship events and incubation programmes. Business of Design Week (BODW), HKDC’s annual flagship event since 2002, Design Incubation Programme (DIP) and Fashion Incubation Programme (FIP) serve the roles in facilitating creative exchanges and showcasing Hong Kong and Mainland talents to the rest of the world as well as nurturing the design talents.

Hashtag: #HKDC

![]() https://hk.linkedin.com/company/hong-kong-design-centre

https://hk.linkedin.com/company/hong-kong-design-centre![]() https://www.facebook.com/hkdesigncentre/

https://www.facebook.com/hkdesigncentre/![]() https://www.instagram.com/hkdesigncentre/

https://www.instagram.com/hkdesigncentre/

The issuer is solely responsible for the content of this announcement.

About Hong Kong Design Centre

A non-governmental organisation registered in 2001 and established in 2002, Hong Kong Design Centre (HKDC) is a strategic partner of the HKSAR Government in establishing Hong Kong as an international centre of design excellence in Asia. Our public mission is to promote wider and strategic use of design and design thinking to create business value and improve societal well-being. Learn more about us at ![]() www.hkdesigncentre.org.

www.hkdesigncentre.org.

Gaw Capital Partners and A3 Capital Jointly Form a JV Platform with the Launch of the first Infinaxis Data Centre in Malaysia

Malaysian Investment Development Authority (MIDA) and Malaysia Digital Economy Corporation (MDEC) Welcome the JV Partnership to Enhance Digital Infrastructure in Malaysia

SINGAPORE/KUALA LUMPUR, MALAYSIA – Media OutReach – 23 February 2023 – Real estate private equity firm Gaw Capital Partners announced today that the firm, has formed a JV platform jointly with A3 Capital to invest into greenfield and under-performing data centre assets across key markets in the Southeast Asia region. The collaboration is aimed to create a portfolio of Tier-3 certified data centre assets. This JV platform will also launch the Infinaxis Data Centre platform with a focus on developing Internet Data Centre (IDC) assets across the Southeast Asia region. The data centre assets under the JV platform will be managed by Infinaxis, staffed by an experienced data centre team originally under A3 Capital. The JV platform’s first investment is located in Cyberjaya, Kuala Lumpur, Malaysia, with other pipeline opportunities in other neighboring countries like Indonesia and Singapore.

Cyberjaya is one of the largest IDC hubs in Malaysia, housing 67 per cent of the Multi-Tenant Data Centre market in Malaysia as of Q2 2021. Considered as the “Silicon Valley of Malaysia”, Cyberjaya, spanning around 29 square kilometers, is the nucleus of the Multimedia Super Corridor in Malaysia. Cyberjaya houses over 2,000 businesses, including SMEs, startups and multinational companies such as IBM, Fujitsu, Panasonic and Huawei, as well as seven universities, turning it into a regional and global ICT hub. Located in Cyberjaya, the seed investment consists of two greenfield sites with a combined plot area of 12,490 square meters. The JV platform will develop a 12 MW IT load IDC facility on one of the plots. The IT capacity will potentially be doubled in the future, with the second plot to be developed as an expansion site. The data centre assets under the JV platform will be operated by Infinaxis, which consists of seasoned industry experts with decades long track records in data centre, real estate and technology industries.

Kok Chye Ong the Managing Director and Head of IDC Platform, Asia (Ex-China) of Gaw Capital Partners said “Gaw Capital Partners is honored to work together with Infinaxis Data Centre Holdings as the platform operator. By forming this strong partnership, we will develop, acquire or reposition four to five data centres in different locations throughout Southeast Asia. The data centre demand in Malaysia is underpinned by strong internet traffic and high amount of data consumption. In recent years, the internet data growth in these areas have been further accelerated by the continued digital transformation of enterprises and 5G penetration. Also, several government initiatives over the last decade have made Malaysia an attractive market for data centres. However, the supply of quality data centres has not caught up with the technical demand from customers. We look forward to exploring more investment opportunities in this market.”

Zahri Mirza, Chief Executive Officer (CEO) for Infinaxis further added, “The outlook for data centre demand in Southeast Asia is indeed highly positive and our collaboration with Gaw Capital will allow us to fast track the delivery of services for our customers. Indeed, through our Gaw Capital partnership we have been able to gain support from MIDA and MDEC in processing the necessary regulatory approvals in a timely manner.”

The Malaysian Investment Development Authority (MIDA) and Malaysia Digital Economy Corporation (MDEC) welcome the JV partnership formed by Gaw Capital Partners and A3 Capital to launch the Infinaxis Data Centre platform, enhancing digital infrastructure in Malaysia. Data center facilities are now at the forefront of innovation and have been supporting the demand for mission-critical digital infrastructures and the cumulative growth of data. Not only do businesses rely on data centers for storage, but for disaster recovery and data management too.

Datuk Wira Arham Abdul Rahman, CEO of MIDA said “My sincere compliments to Gaw Capital Partners and A3 Capital for launching the Infinaxis Data Centre platform. Malaysia is the location of choice for industry leaders to site their best-in-class data centres. These combined efforts will definitely play a key role in enhancing our digital infrastructure.”

“The Government is committed to growing Malaysia as a data centre hub by developing infrastructure, facilitating innovation and strengthening frameworks guided by the MyDigital Blueprint and National Investment Policy (NIP). Anchored by the National Investment Aspirations (NIA), the NIP will outline practical strategies to prioritise nurturing innovative, high-impact, high-tech investments that create high value jobs,” added Datuk Wira Arham.

Ts. Mahadhir Aziz, CEO of MDEC, said, “As the nation’s lead digital economy agency, we are pleased to have facilitated this expansion in raising the overall infrastructure capacities in the data centre sector. This will be crucial as we seek to continue accelerating the growth of our digital economy, guided by the new national strategic initiative, Malaysia Digital (MD). MDEC will strive to form more effective collaborations and drive further facilitation on this front to ensure that the nation remains competitive and attractive to investments, towards establishing Malaysia as the digital hub of ASEAN.”

The JV platform is committed to incorporating ESG principles. Infinaxis plans to apply a staged implementation of more advanced sustainability features over time, considering the availability of options and unique circumstances at the respective sites. The data centres will be more efficient and sustainable, fundamentally making them more competitive which will increase the platform’s long-term value.

Gaw Capital Partners was named ‘Alternatives Investor of the Year: Asia’ at the PERE Awards 2021 after receiving the largest number of votes in a public ballot of the real estate industry. In recent years, IDC has been a focus sector for Gaw Capital Partners as the data centre industry is one of the cornerstones of the digital economy, which is growing rapidly with broad prospects. The firm was also highlighted for launching two data centre platforms in China and two in Pan-Asia. In September 2020, the firm closed fundraising for its first IDC platform, which invested in a portfolio of projects in partnership with IDC developers and operators in China, bringing the total equity raised to approximately USD1.3 billion with the aim to build “green, efficient, innovative and recyclable” data centre clusters.

The Asia region represents as one of the geographic frontiers in the data centre space with greater opportunities. The Gaw Capital data centre platform will also comprise data centres located in China, Indonesia, Japan, South Korea, Vietnam and now in Malaysia.

Hashtag: #GawCapitalPartners

The issuer is solely responsible for the content of this announcement.

About Gaw Capital Partners

Gaw Capital Partners is a uniquely positioned private equity fund management company focusing on real estate markets in Asia Pacific and other high barrier-to-entry markets globally. Specialising in adding strategic value to under-utilized real estate through redesign and repositioning, Gaw Capital runs an integrated business model with its own in-house asset management operating platforms in commercial, hospitality, property development, logistics, IDC and education. The firm’s investments span the entire spectrum of real estate sectors, including residential development, offices, retail malls, serviced apartments, hotels, logistics warehouses and IDC projects.

Gaw Capital has raised seven commingled funds targeting the Greater China and APAC regions since 2005. The firm also manages value-add/opportunistic funds in the US, a Pan-Asia Hospitality Fund, a European hospitality fund and a Growth Equity Fund, and it provides services for credit investments and separate account direct investments globally. Since 2005, Gaw Capital has commanded assets of US$33.6 billion under management as of Q3 2022.

About A3 Capital

A3 Capital is a privately held specialist Real Estate investment platform based in Singapore with origination and execution capabilities across Asia Pacific. The founders have over 80 years of combined experience in Real Estate investment management, capital markets and finance, having managed over US$4bn worth of AUM across different geographies. A3 Capital organizes its activities in the following areas: –

- Real Estate Fund Management – develop real estate fund strategies in partnership with global investment funds and private equity investors;

- Asset Management – execute real estate strategies on behalf of global funds and institutions;

- Syndication – source, structure and invest alongside partners in opportunistic/open ended real estate and other asset-based strategies.

About Infinaxis Data Centre Holdings

Infinaxis is a data centre developer and operator and positioned to build a Data Centre platform in Southeast Asia. The team has deep DC knowledge with extensive experience in execution across the entire data centre life cycle of investment, site acquisition, financing, development, operations and divestment. Headquartered in Singapore, Infinaxis is uniquely positioned to tap the growing demand for digital infrastructure and services in the region. Our mission is to help organizations grow in digital transformation by providing state-of-the-art facilities and best-in-class services.

About Malaysia Investment Development Authority (MIDA)

MIDA is the government’s principal investment promotion and development agency under the Ministry of International Trade and Industry (MITI) to oversee and drive investments into the manufacturing and services sectors in Malaysia. Headquartered in Kuala Lumpur Sentral, MIDA has 12 regional and 21 overseas offices. MIDA continues to be the strategic partner to businesses in seizing the opportunities arising from the technology revolution of this era. For more information, please visit ![]() www.mida.gov.my and follow us on Twitter, Instagram, Facebook, LinkedIn, TikTok and YouTube channel.

www.mida.gov.my and follow us on Twitter, Instagram, Facebook, LinkedIn, TikTok and YouTube channel.

About Malaysia Digital Economy Corporation (MDEC)

MDEC is the agency under the Ministry of Communications and Multimedia Malaysia leading the digital transformation of the economy for 26 years. We aim to enable a progressive, innovation-led digital economy. MDEC will continue to lead Malaysia towards becoming a globally competitive digital nation through the development and execution of Malaysia’s Digital initiative, which aims to create substantial digital tools, knowledge and income opportunities. Malaysia Digital is set to enhance Malaysia’s value proposition to attract digital investments, firmly establishing Malaysia as the digital hub of ASEAN. For more information, please visit ![]() www.mdec.my.

www.mdec.my.

A.M Aesthetics: One of The Largest SGX-Listed Aesthetic Company Generated Revenue of S$6.6 million in HY2023, a 24.5% Increase Compared to HY2022

Since its inception, A.M. Aesthetics has been on a quest to empower individuals to take charge of how they feel and look, and is dedicated to delivering beauty treatments that promote confidence. A.M. Aesthetics treats a wide range of skin issues under one roof, from acne to dull skin, pigmentation to skin sagging. Whatever your aesthetic goals are, they provide specialised and personalised treatments for you.

When asked about recent developments, Dr. Terence Tea, founder of A.M Aesthetics, said, “I believe that along with doctors’ individual skills and expertise in aesthetics, our advanced technology at A.M Aesthetics is efficient in giving our patients a boost in skin youthfulness and a perk in confidence. It gives them a better outlook on life and makes them look forward to waking up feeling younger every morning.” Dr. Terence Tea has been awarded Pingat Bakti Masyarakat by the PMO and Top Leading Entrepreneur 2022/2023 by Vision Media Group.

Thanks to Dr. Terence Tea’s hard work and determination, A.M Aesthetics has expanded to two more outlets in Orchard Central and Clarke Quay Central since September 2022, with an upcoming outlet in Northpoint City and VivoCity, where a brand new 2.0 lifestyle and aesthetic concept is being introduced in these outlets.

In addition to its nine Singapore locations and one Malaysia location, the company through a collaboration with a renowned doctor, providing training and recommending the most cutting-edge aesthetic equipment and skincare products.

Currently, work is underway for new outlets at AM Thailand BKK, AM Malaysia Bangsar, and more. Also, A.M Aesthetics won the “Best Rejuvenating Aesthetic Treatment” award under L’Officiel Singapore’s Spa Awards 2022 for the A.M Aesthetics’ Sylfirm X Ultimate Edition and Daily Vanity Beauty Treatment Awards 2022 (Reader’s Choice) for their Rejuran Treatment and Q-Switch Treatment.

Hashtag: #amaesthetics #amaestheticssg

![]() https://www.facebook.com/amaesthetics.sg/

https://www.facebook.com/amaesthetics.sg/![]() https://www.instagram.com/amaesthetics.sg/

https://www.instagram.com/amaesthetics.sg/

The issuer is solely responsible for the content of this announcement.

About Accrelist Ltd. (亚联盛控股公司)

Listed on the Catalist board of the SGX-ST, Accrelist Ltd. (the “Company” or “Accrelist” together with its subsidiaries, the “Group”) seeks to create long-term value for our shareholders and business partners by unlocking and adding value to the companies we invest in. The Group continues to actively pursue new opportunities with a growing focus on medical aesthetics.

The Group’s wholly owned subsidiary corporations include the Accrelist Medical Aesthetics group of companies, branded as A.M Aesthetics, and A.M Skincare Pte. Ltd. (“A.M Skincare”).

A.M Aesthetics operates a chain of registered medical aesthetics clinics in Singapore and Malaysia which use state-of-the-art equipment and clinically proven solutions to deliver a wide range of highly reliable and effective treatments. A.M Skincare is principally involved in the retail sale of pharmaceutical and medical goods. It develops and distributes its own original design manufacturer clinical skincare products (“ODM”) with support from South Korean dermatologists alongside other non-ODM products.

In addition, Accrelist holds a 53.31% controlling stake in Jubilee Industries Holdings Ltd. (“Jubilee”), a one-stop service provider with two main business segments:

- Mechanical Business Unit (“MBU”) which is engaged primarily in precision plastic injection moulding and mould design and fabrication services; and

- Electronics Business Unit (“EBU”) which distributes integrated electronic components.

Headquartered in Singapore, Jubilee’s production facilities span across Malaysia and Indonesia. Jubilee’s products are sold to customers in Singapore, Malaysia, Indonesia, Vietnam, India, the People’s Republic of China, the United States and various European countries.

For more information, please visit ![]() www.accrelist.com.sg

www.accrelist.com.sg

About A.M Aesthetics

Having been the Executive Chairman and Managing Director of Accrelist Ltd., Dr. Terence Tea established “A.M. Aesthetics” in 2018. A.M Aesthetics is a team of experienced professionals dedicated to offering their clients trustworthy cosmetic dermatology and skin laser treatments. They have strategically placed outlets in different areas of Singapore and Malaysia.

Baidu to Implement ChatGPT-like Ernie Bot Chatbot from March

HONG KONG (AP) — Baidu Inc., one of China’s biggest search and artificial intelligence firms, said Wednesday it plans to implement its artificial intelligence chatbot Ernie into its search services from March.

Family: Man Shot by Police Couldn’t Hear, Speak English

ST. PAUL, Minn. (AP) — Relatives of a man who was fatally shot by St. Paul police argued Saturday that the 65-year-old struggled to understand orders to drop a traditional Hmong knife because of a language barrier and extreme hearing loss.