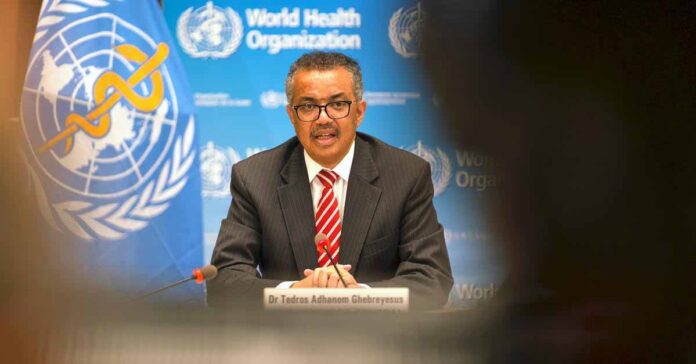

The valuation shows confidence in Babel Finance from many of the world’s leading investment institutions and investors. With this market support, Del Wang, the Co-Founder and CEO of Babel Finance, is confident in that crypto can be a solid hedging tool to manage market volatility. Crypto miners and mining investors stand to gain.

Low-cost energy prices were formerly the primary focus for the crypto mining sector, but as Bitcoin and other tokens grew more market-oriented and mining becomes increasingly institutionalized, crypto miners require sophisticated financial services to boost asset liquidity and hedge risk.

In the crypto mining industry, there are several essential variables for successful operations, which are:

- The cost of electricity.

- The computational power of the entire network.

- The cost of mining machines.

- The currency price.

Crypto mining machines and electricity expenses are generally fixed costs. Currently, the market’s financial products are largely geared to cope with currency price swings to decrease risk and boost profits.

High Yield or High Stability

Before selecting a financial product, it is vital to confirm the crypto miners’ requirements for the nature of the financial product.

Crypto mining is a capital-intensive industry. Crypto miners must invest a significant amount of capital in purchasing computing power and paying for electricity. The primary objective of miners employing financial instruments is to hedge the risk of currency price volatility. Thus they want to pay for mining capacity and costs with steady earnings and cash flow.

“Crypto mining has evolved into a mature commercial activity. Pursuing high stability as a commercial activity is not just about maximizing profits,” says Del Wang.

Financial Product Options

Currently, the most common financial instruments on the market take advantage of both up and down movements in the market. Crypto miners are more likely to hoard currency if the present price is low and the future outlook is optimistic. Computers and power bills, on the other hand, must be paid on regular terms. Loans backed by crypto are frequently used by miners in this situation, which is good leverage.

Another strategy is to use futures. If the present cryptocurrency price is high, miners who are pessimistic about future currency prices and will be able to sell future un-produced bitcoins at the current higher price. Miners must select the proper leverage direction according to their liquidity and risk tolerance.

Risk hedging

Hedging is a futures contract in the futures market that buys (or sells) the same commodity in the opposite direction as the spot market, trades in both markets in the opposite way, and loses money in one market while making money in the other. A profitable market exists. To meet the goal of minimizing risks, the amount of loss is about equal to the amount of profit.

The goal of hedging for miners is to eliminate or hedge risk. If miners feel that the current currency price has reached a high level and that the market may tip, they can opt to hedge to lock in gains in advance.

Risk hedging is not without costs. If the forecast for the future market direction is incorrect, and the currency price rises in the future, the benefits from the currency price increase will be lost. However, the pursuit of high risk-reward ratios is not the primary goal of institutional miners. It is critical to lock in benefits early to guarantee that miners can ride out the risk.

Final Thoughts

The cryptocurrency market will continue to be volatile, especially given the Fed’s hiking of interest rates and the uncertain geopolitical situation arising amid the Ukraine crisis, believes Del Wang. No doubt mining competition will be fiercer too. The integration of financial services and crypto mining is an unavoidable tendency in the evolution of the crypto mining sector. Miners must become more self-aware, improve financial management and control skills, and avoid the raw risks associated with carrying large amounts of fixed assets. Miners can’t just go for the highest possible return for financial products. It would be best to consider their liquidity and risk tolerance before deciding on an acceptable leverage direction.

#BabelFinance