American credit rating agency Moody’s has assigned a B3 rating with a positive outlook to the government of Laos, citing the country’s high economic growth potential.

The rating agency pointed out, however, the country’s weak executive institutions, limited transparency, and the small economy could be potential challenges.

It is the first time for Laos to receive such a rating from one of the three major international rating agencies. The other two are Standard & Poor’s and Fitch Group.

Having sovereign credit ratings means investors can have insights into the level of risk associated with investing in the debt of a particular country, including any political risk.

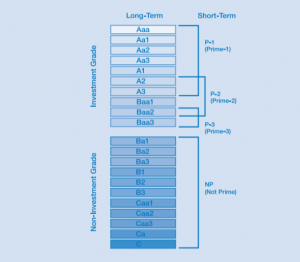

Moody’s rating scale ranges from a maximum Aaa to a minimum C, consists of 21 notches and two categories, namely the investment category for the financially sound companies and speculative category for the companies with a higher risk of default.

Rating B, which is divided into B1, B2, and B3, falls into the speculative category, and the agency suggests that it is “subject to high credit risk.”

Other countries on this scale include Angola, Belarus, Ecuador, Mongolia and Pakistan.

Supporting factors

Moody’s laid out four factors that support the rating.

Laos received “ba3” for economic strength, which balances the country’s high economic growth potential against relatively low incomes, the small size of the economy and exposure to environmental risks.

The country was rated with “b3” for the institutions and governance strength, which balances weak executive institutions, low administrative capacity, and very limited transparency and accountability against a lengthening track record of effective monetary management.

The agency gave Laos “caa1” for fiscal strength, which reflects a high government debt burden for the size of the economy and the government’s narrow revenue base that constrains fiscal flexibility, although the largely concessional debt supports debt affordability.

The country got “ba” for the susceptibility to event risk, driven by external vulnerability risk given structural current account deficits and low foreign exchange reserve buffers.

Positive outlook

The positive outlook is driven by Moody’s assessment that the implementation of large infrastructure projects, including the hydropower dams and the Laos-China Railway, if managed effectively, would deliver net positive benefits to the economy and raise government revenue and exports, Moody’s said in a report on January 8.

“This would allow for a faster reduction in the debt burden and alleviate external risks compared with Moody’s current expectations,” the agency added. “Ongoing fiscal reforms, including efforts to widen the tax base and strengthen expenditure and debt management, also have the potential to shore up fiscal strength and Laos’s credit profile over time.”

What could change the rating

Moody’s explained that prospects of a substantial and sustained reduction in the debt burden, including through fiscal consolidation or revenue expansion beyond Moody’s current expectations, would be credit positive.

“This could happen in the context of effective implementation of the large infrastructure projects that raise economic competitiveness and prospects for diversification, increasing the resilience of the economy to shocks, and raise government revenue. In addition, a reduction in external vulnerability risk, in particular through a sustained accumulation of foreign exchange reserve buffers would also place upward pressure on the rating,” it added.

While saying the positive outlook signals that a rating downgrade is unlikely over the near term, the agency noted that downward pressures on the rating would be likely in case of a further weakening of Laos’s external position, evidenced by a decline of already low foreign exchange reserves coverage of imports and external debt.

It cited a weakening of fiscal and debt metrics and further failures in the banking system that involved material fiscal costs and weighed on growth on a prolonged basis because of constrained credit supply as possible factors that would weigh on the rating.

Gearing up international dollar bond debut

The Lao Government engaged in November last year with Standard Chartered, JP Morgan, and Credit Suisse for its planned international US dollar bond debut.

In December of 2015, Laos sold USD 182 million worth of dollar bonds in two tranches to institutional investors in Thailand and regularly issues sovereign bonds denominated in Thai baht, but it has yet to offer a bond to international investors.

At that time, financial advisor Victor Rattanavong of Kindersen Raleigh & Associates said that China and Thailand are two of Laos’s biggest funding sources, but people in Thailand are getting a bit full with credit, and Laos may need to look elsewhere.

“This is potentially good for Laos because of the wider pool of investors, meaning there will be more liquidity for Lao government bonds,” Rattanavong noted.