Consumer interests and business resilience central themes in first set of guidelines published by the Insurance Culture and Conduct Steering Committee (ICCSC)

SINGAPORE – Media OutReach – 22 March 2022 – The Insurance Culture and Conduct Steering Committee (ICCSC) today released its first two papers providing best practice guidelines and recommended initiatives for stakeholders within the insurance ecosystem to elevate the culture and conduct standards of insurance companies, intermediaries (e.g. Financial Advisory Firms), employees, and the insurance ecosystem.

The two Papers[1] are:

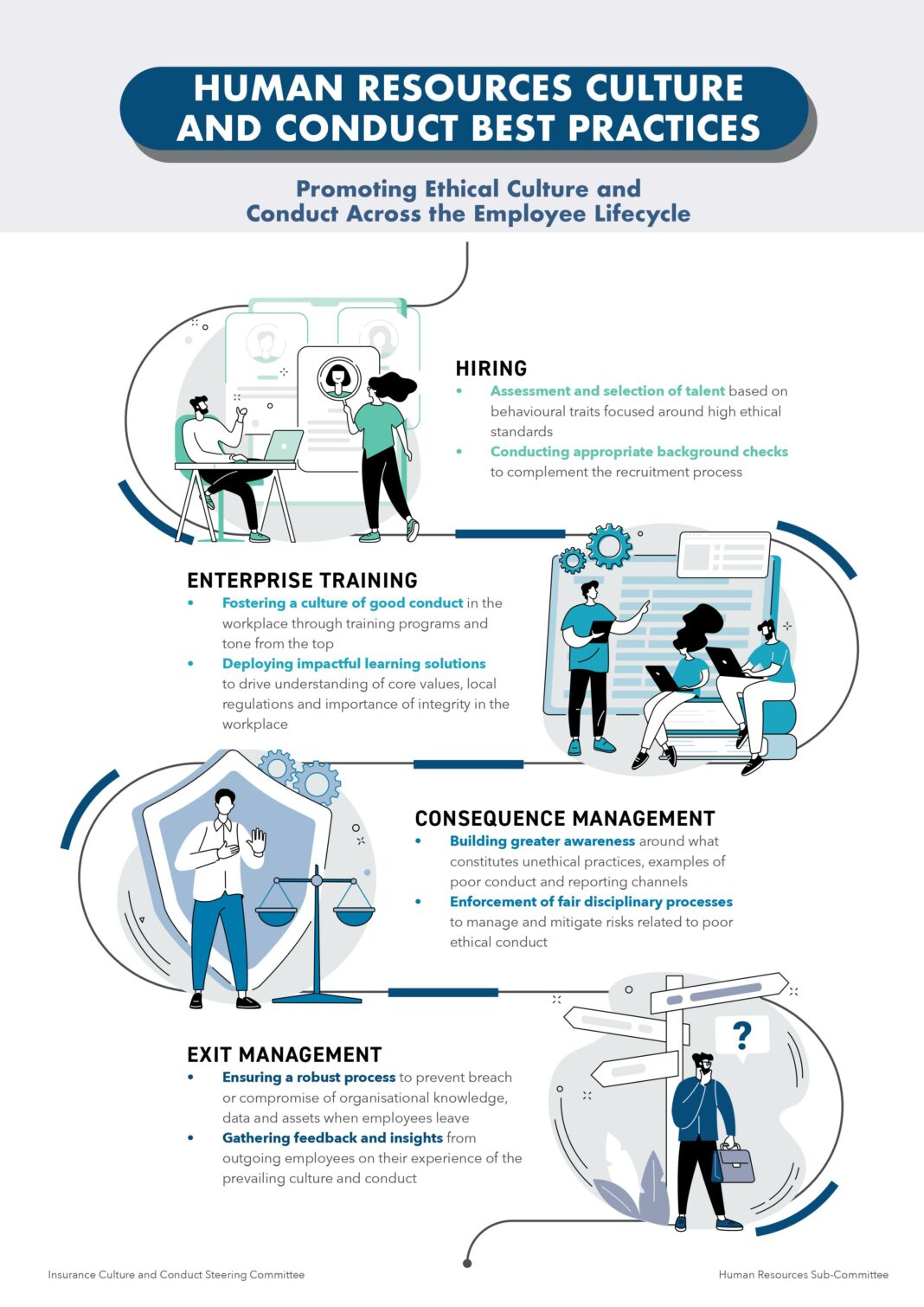

- Human Resources Culture and Conduct Best Practices – Promoting Ethical Culture and Conduct Across the Employee Life Cycle: Outlining best practices in Hiring, Enterprise Training, Consequence Management, and Exit Management

- Corporate Governance Culture and Conduct Best Practices – Promoting Ethical Culture and Conduct Through Corporate Governance and Systems: Putting forth recommendations on the role of Leadership, Governance & Systems, Capability & Capacity, and Performance Management & Remuneration

Mr Marcus Lim, Assistant Managing Director (Banking & Insurance), Monetary Authority of Singapore, said, “The ICCSC has demonstrated its commitment to promote good culture and conduct within the insurance sector through the publication of these best practices and recommendations. By continually serving the best interests of their customers, insurers and intermediaries reinforce the foundation of trust upon which the industry is built. MAS encourages all firms to take reference from this set of papers and consider how best to apply them to their business so as to better serve their customers.”

Dr Khoo Kah Siang, Chairperson of the Insurance Culture and Conduct Steering Committee (ICCSC) said, “The papers are developed based on extensive research carried out on best practices observed internationally, and inputs from senior practitioners within the industry. We hope that these papers will provide timely and practical guidance to the insurance companies in Singapore to apply and elevate their standards of culture and conduct over time, to maintain public trust and confidence in the insurers.”

“ICCSC will continue to work with the various insurance associations in Singapore to adopt these guidelines as appropriate for their segment. These best practices papers will be reviewed in 12 months to assess the effectiveness of the recommendations for the industry.”

These Papers focus on people, performance, and processes:

- People: From the leadership team to employees and Financial Adviser (FA) Representatives – every individual has a critical role to play in creating a strong culture of good conduct for the benefit of insurance customers. The best practice guidelines and recommendations put forth clear roles and responsibilities of the respective parties in promoting the right culture and conduct in the organisation.

- Performance: Assessment criteria – whether for hiring, reward, or recognition – can be enhanced to include financial and non-financial measures. The performance of the management team, employees, FA representatives and partners in the ecosystem can be raised by having the right training programs and consequence management framework.

- Processes: Recommended enhancements to the governance and ways of working to establish and enforce more robust practices to promote good conduct and the right culture within organisations and the insurance eco-system at large.

“I would also personally like to thank all the ICCSC members as well as contributors in the subcommittees who had volunteered their valuable time towards this important initiative for the industry amidst this challenging COVID-19 period,” Dr Khoo added.

The committee, consisting of senior leaders in the industry, was established in December 2019 to foster sound culture and strengthen standards of conduct among insurers in Singapore.[2] They are supported by the General Insurance Association of Singapore (GIA), the Life Insurance Association (LIA) and the Singapore Reinsurers’ Association (SRA).

The ICCSC is currently working on the next best practice paper which will bring a new focus on the conduct of life insurance intermediaries. The aim is to provide practical recommendations on the role of supervisors in setting the right tone from the top and putting in place key performance measures to incentivise FA Representatives to provide customers with high quality financial advisory services. The paper also sets out recommendations to enhance disclosures to customers and information sharing between insurers and non-tied Financial Advisory Firms (FAFs) in order to raise overall standards in the financial advisory industry. This paper is targeted for an April 2022 release.

Appendix 1: Infographic on Human Resources Culture and Conduct Best Practices – Promoting Ethical Culture and Conduct Across the Employee Life Cycle

Appendix 2: Infographic on Corporate Governance Culture and Conduct Best Practices – Promoting Ethical Culture and Conduct Through Corporate Governance and Systems

https://www.sgpc.gov.sg/sgpcmedia/media_releases/mas/press_release/P-20191212-1/attachment/Joint%20Media%20Release%20-%20New%20Industry%20Steering%20Committee%20to%20Elevate%20Culture%20and%20Conduct%20Standards%20for%20Insurance%20Industry.pdf

The issuer is solely responsible for the content of this announcement.