A survey of 150 people who used the services of three central hospitals in Vientiane Capital in April 2023 found that only 20 percent, or 30 people, were satisfied with the services provided.

DrGo launches innovative DrGo Me+ personalised nutritional supplement pack

Handy packets tailored with professional health survey to address daily nutritional needs

HONG KONG SAR – Media OutReach – 31 August 2023 – HKT (SEHK: 6823) – DrGo, HKT’s one-stop telemedicine platform, announced the launch of DrGo Me+, an innovative personalised nutritional supplement pack. Based on advice from professional nutritionist and pharmaceutical body, DrGo Me+ puts together customised nutritional supplements in handy daily packets and delivers them directly to the user’s doorstep. DrGo Me+ revolutionises the concept of bespoke healthcare, providing users with a more convenient and tailored approach to a healthy lifestyle.

“My Personalised Supplement Pack”: Professional nutritional care tailored to personal needs

Driven by its commitment to leveraging advanced technology for effortless personal health management, DrGo has presented an innovative solution for personalised nutrition supplementation through DrGo Me+.

By simply accessing the DrGo Me+ platform, users are guided through a survey1 designed by a nutritionist and validated by the Hong Kong Pharmaceutical Care Foundation, aiming to provide insights about their lifestyle, dietary habits, and health goals. Upon completion of the survey, DrGo will instantly generate a curated list of recommended supplements tailored for the user, with information on the health benefits of each type of supplement.

Daily personalised pack of supplements, meeting user’s daily nutritional supplement needs

DrGo Me+ packages the supplements into personalised daily packs according to daily requirements before dispatching them to the user’s designated location in Hong Kong. With just one pack a day or to take as needed, users can effortlessly meet their nutritional supplement needs, sparing them from the hassle of storing and carrying multiple bottles while helping to reduce the chance of missing doses, hence help to reap the most benefits from the supplements.

DrGo Me+ offers monthly subscription plans spanning 30 or 90 days that can be cancelled or modified2. With an average price of HK$282, users can enjoy a 30-day plan of up to four supplements that cater to their health needs along with delivery, ensuring that their health regimen will not be interrupted.

Teresa Ng, Chief Commercial Officer of DrGo, said, “The consumption of health supplements as a means to enhance one’s wellbeing has become a growing trend. Even the younger members of the workforce are seeking nutritional supplements to improve their physical health and augment their work performance. Yet the market is overflowing with a bewildering variety of such products, often making it difficult for consumers to find products that genuinely cater to their health needs. They may also realise, only after consumption, that the product has fallen short of their expectations. Professional guidance is rarely sought prior to making such purchases. DrGo Me+ aims to address these challenges by empowering users with an understanding of their personal nutritional needs with professional guidance. From the comfort of their homes, users can access nutritional supplements tailored to their personal health needs conveniently and efficiently.”

Terry Chiu, Council Member of the Hong Kong Health Foods Association and collaborating partner of DrGo, said, “A survey3 conducted by the Hong Kong Health Foods Association in October 2020 revealed that about 90% of respondents are in the habit of purchasing health products. Notably, nearly 40% of those polled indicated that they had purchased more health products since the onset of the pandemic, with the intention of bolstering their immunity. These findings underscore the public’s eager pursuit of health products that are of high quality and effective.”

S.C. Chiang, Director from the Hong Kong Pharmaceutical Care Foundation emphasised the crucial importance of expert advice in maximising benefits derived from nutritional supplements. “Distinct health challenges, such as sleep irregularities, psychological stress, skin conditions as well as gastrointestinal and immune health, can be addressed through the intake of specific nutrients. However, an individual’s nutritional state is shaped by various factors, including dietary habits and lifestyle. This means that the supplementary nutrients and dosage required differ markedly from person to person. A bespoke nutritional plan, therefore, is more effective in meeting individual needs. In fact, the medical community consistently advises that the public consults with professionals prior to taking health products to help prevent excessive intake, which could lead to failure to deliver the expected health benefits and trigger adverse reactions.”

To experience personalised nutritional supplement packs from DrGo Me+, please visit our website at www.drgohealthstore.com.hk/meplus-supplement/.

To register with DrGo, please download the DrGo app at https://drgohkt.page.link/download_app. For more details, please call DrGo’s service hotline at +852 2380 2323 or visit DrGo’s website at www.drgo.com.hk.

Remarks:

1 The survey and suggestions of supplements were designed by nutritionist Mandy Wong and endorsed by the Hong Kong Pharmaceutical Care Foundation.

2 A user’s subscription of personalised pack will be automatically renewed every 30 / 90 days (depending on whether the user has subscribed to a 30-day or 90-day plan). A user may cancel or modify the automatic renewals at least 3 days prior to the expiry date of the 30-day / 90-day plan.

3 The survey was conducted by the Hong Kong Health Foods Association from 5 to 18 October 2020, during the 2020 epidemic period, on Hong Kong people’s health supplement consumption habits, with 570 individuals successfully interviewed and a 92% response rate.

To download the relevant images: https://bit.ly/DrGoMePlusPhotoLibrary

Hashtag: #DrGo #Me+ #Personalisednutritionalsupplementpack #Nutrition #Supplement #TeresaNg

The issuer is solely responsible for the content of this announcement.

About HKT

HKT is a technology, media, and telecommunication leader with more than 150 years of history in Hong Kong. As the city’s true 5G provider, HKT connects businesses and people locally and globally. Our end-to-end enterprise solutions make us a market-leading digital transformation partner of choice for businesses, whereas our comprehensive connectivity and smart living offerings enrich people’s lives and cater for their diverse needs for work, entertainment, education, well-being, and even a sustainable low-carbon lifestyle. Together with our digital ventures which support digital economy development and help connect Hong Kong to the world as an international financial centre, HKT endeavours to contribute to smart city development and help our community tech forward.

For more information, please visit ![]() www.hkt.com.

www.hkt.com.

LinkedIn: linkedin.com/company/hkt

About DrGo

DrGo is an end-to-end app-based platform connecting users with Hong Kong registered medical practitioners, Hong Kong registered / listed Chinese medicine practitioners and other healthcare professionals who will provide medical and healthcare consultation services and advice via video consultation on mobile device. Certain prescribed medicine will be delivered to the user’s designated address. DrGo is the first HealthTech platform pioneered by HKT, offering convenient telehealthcare services via on an end-to-end app-based platform developed and managed locally by HKT professionals. With HKT’s advanced technologies, the entire consultation journey, including service registration, appointment booking, video consultation and payment will take place with encryption, aiming at protecting users’ privacy.

DrGo users in Hong Kong can get access to a one-stop healthcare consultation via their mobile devices. They can speak to medical practitioners, Hong Kong registered / listed Chinese medicine practitioners or other healthcare professional from their home or workplace without the need to making a physical visit or queuing at a hospital or clinic. Remote consultation provides sense of ease and convenience, which is particularly important at a time when social distancing is critical during the current pandemic. Furthermore, DrGo received the “Technology – Best Telemedicine Mobile App” award from The Global Economics Awards 2022 and took Silver in the “Public Affairs and Social Innovation” category of Asia Smart App Awards 2021. These significant global awards are testament to DrGo’s cutting-edge innovation and professional service standard, which have earned the trust of its customers.

At present, DrGo is partnering with over 100 healthcare professionals from the below medical organisations to provide remote telemedicine and healthcare services: Amazing Medical, Ascendo Health, Dr Wendy Wong’s Clinic, EC Healthcare, Fu Heng Medical Center, Gleneagles Hospital, Healthkit Medical Centre, Hong Kong Medical Concierge, Human Health Medical Centre, Max Medical, Mental Health Association of Hong Kong, Pop Point Medical Center, Precious Blood Hospital (Caritas), Premier of Professional Medical Care Center, Quality Healthcare Medical Services Limited and River Cam Chinese Medicine & Acupuncture Clinic.

About DrGo Me+

All information, recommendation and statements provided under DrGo Me+, including, without limitation, any supplement and other recommendations are merely recommendation only and are not in any way intended to prevent, diagnose, treat or cure any illness; and users are free to decide whether or not to purchase any supplement or other products or services at DrGo Health Store after conducting the survey under DrGo Me+. Supplements recommended by DrGo Me+ are not registered under the Pharmacy and Poisons Ordinance nor the Chinese Medicine Ordinance. Any claim made for or in relation to such supplements has not been subject to evaluation for such registration.

Issued by HKT Limited.

HKT Limited is a company incorporated in the Cayman Islands.

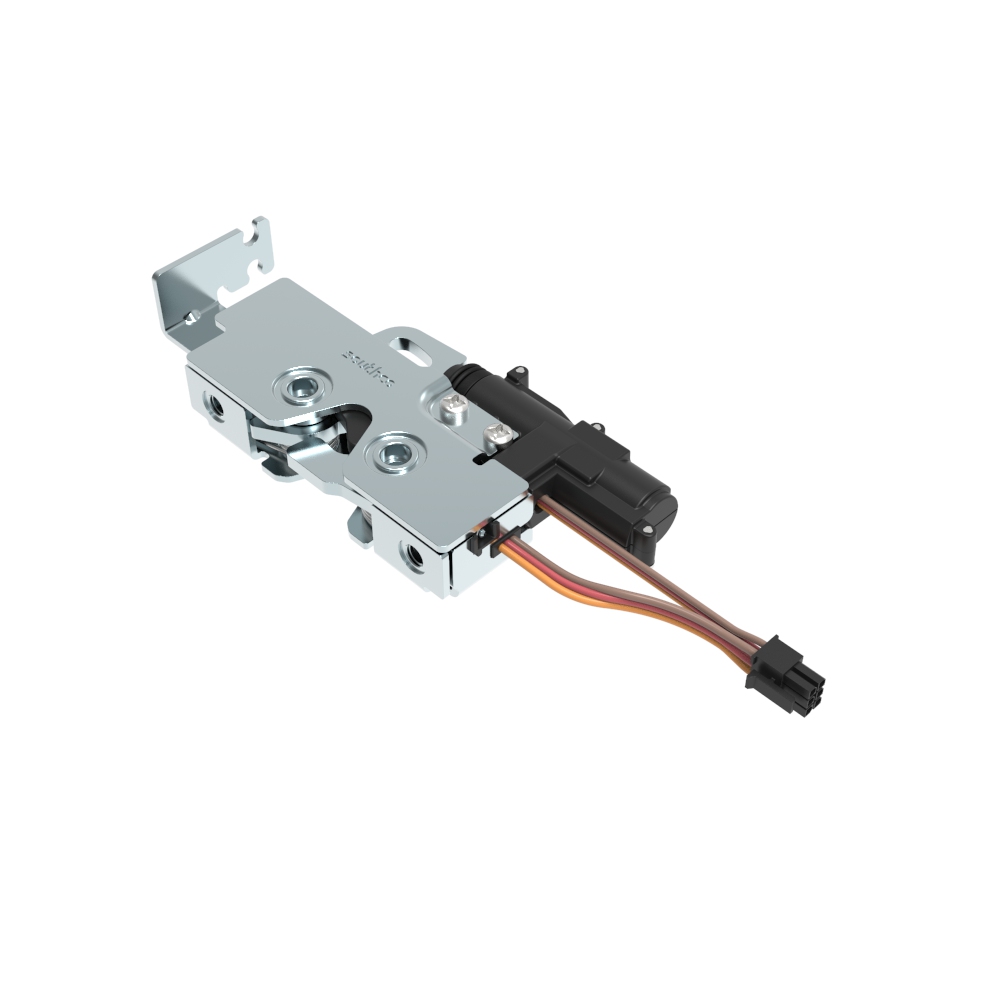

Southco Introduces New High Strength Rotary Latches with Electronic Actuation and Door Status Sensors

Southco’s new R4-25 products are a response to customer requests for electronic control and monitoring in demanding applications. A 12 volt actuator can actuate the latch with a signal from the customer’s control system or a Southco controller. The R4-25 pairs well with Southco’s BluetoothTM controller for wireless operation. An integrated sensor communicates when the door striker is present to indicate that the door is closed.

The R4-25 latches feature a symmetric design that enables them to be used in either right and left hand positions. This reduces stock requirements, speeds assembly, and improves inventory management. In addition, the integrated cable mounting bracket eliminates the need for the purchase or design of a separate cable mounting bracket.

Southco Product Manager Cindy Bart adds, “These new R4-25 rotary latches expand our portfolio of mechanical and electronically actuated rotary latches. We are building on our experience in both areas to bring electronic actuation capability to new markets.”

For more information about the functionality of R4 Rotary Latches, please visit southco.com or email the 24/7 customer service department at info@southco.com.

Hashtag: #southco #Latchsensor #securitysystem #RotaryLatch

The issuer is solely responsible for the content of this announcement.

About Southco

Southco, Inc. is the leading global designer and manufacturer of engineered access solutions. From quality and performance to aesthetics and ergonomics, we understand that first impressions are lasting impressions in product design. For over 70 years, Southco has helped the world’s most recognized brands create value for their customers with innovative access solutions designed to enhance the touch points of their products in transportation and industrial applications, medical equipment, data centers and more. With unrivalled engineering resources, innovative products and a dedicated global team, Southco delivers the broadest portfolio of premium access solutions available to equipment designers throughout the world.

BingX Lists PayPal USD (PYUSD) and Ovato (OVO)

Hashtag: #bingx #cryptoexchange #copytrading #coinlisting

The issuer is solely responsible for the content of this announcement.

About BingX

Crayon and JBS announce global partnership to enhance Japanese customers’ success

Japanese International Companies to benefit from Crayon core services and worldwide support

TOKYO, JAPAN – Media OutReach – 31 August 2023 – Crayon (OSE: CRAYN), a global leader in IT services and innovation, and Japan Business Systems Inc (JBS), a leading technology solutions provider, today announced the signing of a strategic partnership.

The key focus of the newly formalized partnership is to offer Japanese international firms the ability to purchase Microsoft licenses anywhere in the world, and the deal brings enhanced value to companies’ IT investments. By integrating Crayon’s global operations, renowned Software Asset Management (SAM), and cost optimization services, JBS aims to deliver a holistic suite of services to its customers worldwide. Both companies will further collaborate in AI and security domains centred on Microsoft technologies, advancing customers’ digital transformation efforts.

“I have deep respect and admiration for JBS and believe we have a common business approach to customers,” said Crayon CEO Melissa Mulholland. “We are both committed to helping companies maximize cloud-based services and innovating to enable global success. In addition, JBS’s philosophy of ‘bringing the best technology to everyone, everywhere’ aligns with our belief in ‘the power of technology to drive the greater good.’ Our companies are very synergistic and I’m looking forward to helping more businesses grow through this global partnership.”

The alliance between Crayon and JBS marks an exciting chapter in both companies’ growth and their commitment to providing world-class IT solutions for Microsoft customers worldwide.

“We are very pleased to announce our global business partnership with Crayon, one of the top 10 leading Microsoft partners in the world,” said Yukihiro Makita, JBS CEO and President. “By leveraging Crayon’s global business expertise and offices around the world, JBS has established a foundation to better serve Japanese global companies. We will take this opportunity to further contribute to the development of customers’ business.”

This partnership builds upon JBS’s collaboration in Japan with rhipe, a Crayon subsidiary, elevating it to address the broader international requirements of companies based or operating from Japan. These companies are set to benefit from Crayon’s extensive operations across Europe, North America, Asia Pacific, and the Middle East.

“As Japanese businesses extend their reach, the demand for Microsoft licenses and services has surged. Covering 80% of the global market with more than 50 offices in over 40 countries, Crayon is uniquely positioned to support companies in their worldwide operations and aspirations,” said Rhonda Robati, EVP Asia Pacific at Crayon. “We see the Japanese market as a key growth opportunity and as we strengthen our partnership with JBS, we will continue to invest to enhance both our offering to end customers and our partner base.”

Hashtag: #Crayon #JBS #Microsoft #Technology #Japan #ITCostOptimization

![]() https://www.linkedin.com/company/crayon-group/

https://www.linkedin.com/company/crayon-group/

The issuer is solely responsible for the content of this announcement.

Crayon

Crayon is a customer-centric innovation and IT services company with over 4,000 team members across 46 countries. We optimize businesses’ IT estate to help them innovate with expertise they can trust. Our services create value for companies to thrive today, and scale for tomorrow. For more information, visit ![]() www.crayon.com.

www.crayon.com.

BingX BTCUSDT scored industry lowest Slippage after Advanced Perpetual Futures Upgrades

High slippage has poses a significant challenge in crypto trading as it undermines the accuracy and predictability of transactions. This occurs when the executed price deviates substantially from the expected price, leading to increased costs for traders and potential profit erosion. Such unpredictability can adversely impact trading strategies, making it difficult to enter or exit positions at desired levels.

After BingX Perpetual Futures Upgrades, BingX outperformed its counterparts by an impressive 78%, demonstrating its unwavering commitment to delivering an unparalleled trading experience for its users.

For transactions involving BTCUSDT single transaction values ranging from $0 to $50,000, BingX boasts an average slippage of just 0.084. This highlights BingX’s extraordinary 74% improvement in slippage reduction, reaffirming its dedication to ensuring optimal trading conditions. This applies to BTCUSDT spot and BTCUSDT Futures transactions.

In the realm of higher-value transactions, BingX continues to shine. For BTC transactions ranging from $50,000 to $100,000, BingX’s average slippage stands at a mere 0.088. That is an astounding 80% improvement in slippage performance. BingX once again emerges as the leader in the trading arena.

Furthermore, BingX demonstrates its exceptional capabilities in transactions involving larger amounts. For BTC single transactions valued between $100,000 and $500,000, BingX maintains an average slippage of only 0.13. This immense 83% enhancement in slippage reduction underscores BingX’s unassailable position as the preferred platform for traders seeking the utmost precision and reliability.

BingX’s remarkable achievement in reducing slippage reaffirms its dedication to pushing the boundaries of what is possible in the world of cryptocurrency trading. With an average outperformance of 78%, BingX cements its position as the go-to platform for traders seeking superior accuracy, reliability, and performance in Bitcoin Price. Making BingX a clear choice when dealing with larger funds. Overall, this improvement brings larger value to big time investors, especially for higher market cap coins like BTCUSDT and ETHUSDT traders.

Hashtag: #bingx #cryptoexchange

The issuer is solely responsible for the content of this announcement.

About BingX

Inflation Rate Drops Slightly in August, But Worries Still Cloud Lao Economy

The country recorded an inflation rate of 25.88 percent in August, a slight decrease from July’s rate of 27.80 percent, as per information from the Lao Statistics Bureau (LSB).

Bybit’s New Launchpad 3.0: Pioneering Transparent Cryptocurrency Launches

Bybit Launchpad 3.0 is a pioneering token launch platform that offers investors the exclusive opportunity for early access to new and pre-listed tokens from promising projects, directly accessible on the Bybit platform. The platform is a bridge, connecting project developers with potential investors and ensuring a more streamlined and transparent token launch process.

To participate, investors commit specific amounts of Mantle (MNT) or Tether (USDT) towards each new project, resulting in the acquisition of new tokens. After the commitment period is over, the initial sums are returned. Bybit Launchpad 3.0 is open to users who have successfully completed Identity Verification Level 1 requisites and have deposited MNT or USDT into their Bybit Wallet.

For those seeking more opportunities, Bybit Launchpad 3.0 offers a chance to earn additional allocations. Users can achieve this by maintaining a higher average daily Spot trading volume, providing enhanced prospects for participating and benefiting from the launch.

“Bybit Launchpad 3.0 is bringing innovative blockchain projects to the forefront,” said Ben Zhou, co-founder and CEO of Bybit. “We are providing direct access to pre-listing rounds and facilitating the acquisition of new tokens. These tokens then seamlessly transition to trading on Bybit’s trading platform.”

As the first Mantle Network project to feature on the Bybit Launchpad 3.0, Cashtree is Indonesia’s top mobile advertising platform. It has become one of the most reliable platforms to connect brands and advertisers with users with a user base of over 20 million.

The platform has now integrated the Cashtree Token (CTT) into its structure, using Mantle’s Layer 2 infrastructure to transition to a blockchain-based rewards system. With a focus on becoming a gateway to the crypto world, CTT will introduce users to Web3, offering loyalty programs, GameFi, and financial services.

Hashtag: #Bybit #TheCryptoArk

The issuer is solely responsible for the content of this announcement.

About Bybit

Bybit is a top-five cryptocurrency exchange established in 2018 that offers a professional platform where crypto investors and traders can find an ultra-fast matching engine, 24/7 customer service, and multilingual community support. Bybit is a proud partner of Formula One’s reigning Constructors’ and Drivers’ champions: the Oracle Red Bull Racing team.

For more information please visit: ![]() https://www.bybit.com

https://www.bybit.com

For updates, please follow: ![]() Bybit’s Communities and Social Media

Bybit’s Communities and Social Media

![]() https://discord.com/invite/bybit

https://discord.com/invite/bybit

![]() https://www.facebook.com/Bybit/

https://www.facebook.com/Bybit/

![]() https://www.instagram.com/bybit_official/

https://www.instagram.com/bybit_official/

![]() https://www.linkedin.com/company/bybitexchange

https://www.linkedin.com/company/bybitexchange

![]() https://www.reddit.com/r/Bybit/?rdt=51313

https://www.reddit.com/r/Bybit/?rdt=51313

![]() https://t.me/BybitEnglish

https://t.me/BybitEnglish

![]() https://www.tiktok.com/@bybit_official

https://www.tiktok.com/@bybit_official

![]() https://twitter.com/Bybit_Official

https://twitter.com/Bybit_Official

![]() https://www.youtube.com/c/Bybit

https://www.youtube.com/c/Bybit